If you run a dance studio, fitness club, tennis center, or other membership-based business, offering pre-authorized debits (PADs) for monthly payments can simplify billing and improve cash flow. PADs allow you to automatically withdraw funds from your members’ bank accounts, reducing missed payments and administrative headaches.

In this article, we’ll walk you through the process of setting up pre-authorized debits for your monthly payments and membership renewals.

Pre-authorized debits provide several benefits for membership-based businesses:

To start accepting PADs, you’ll need to work with a payment processor that supports bank-to-bank transfers. Some popular options in Canada include:

When selecting a provider, consider:

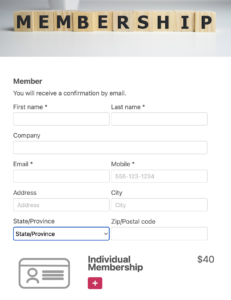

To streamline the process of collecting customer information and obtaining approval, you need a well-designed membership form. Here’s how to create one:

Decide whether you want to use a digital form builder (like Activity Messenger, Google Forms, or JotForm) or a paper-based agreement. We recommend for automation and convenience.

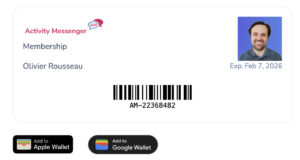

A platform like Activity Messenger allows you members to store their memberships cars in their Apple wallet or Google wallet.

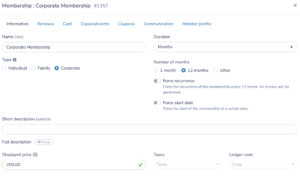

Your form should clearly outline the membership options available, including:

Ensure your form gathers all necessary details:

For PAD payments, you must collect the following banking details:

You can use a void cheque upload option to reduce errors in account entry.

Most payment providers require a legally binding digital signature or a checkbox confirming the customer’s consent to pre-authorized charges. Make sure this is included in your form.

If you use an online form builder, see if it integrates directly with your payment processor to automate onboarding and payment collection. By designing a clear, easy-to-use membership form, you can make it easier for customers to sign up and ensure GDPR compliance.

Stripe fully integrates with Activity Messenger to make payment collection seamless for both customers and businesses.

To encourage adoption of PADs, clearly communicate the benefits to your members. Send an email explaining:

Some businesses also offer incentives, such as small discounts or waived fees, for members who switch to PAD payments.

Using pre-authorized debits can lower your transaction fees. It can also keep your member enrollment process simple and straightforward.

With Activity Messenger, you get lower fees, faster payments, and fewer manual tasks. Plus, it keeps the customer experience high.

| Payment Method | Processing Fees* | Payout | Settlement |

|---|---|---|---|

| Pre-Authorized Debit | 1% + 40c | 5 days | Automated |

| Interac | 0% | Instant | Automated** |

| Credit Card | 2.9% + 30c | 1-3 days | Automated |

| Offline | Yes | Client dependant | Manual |

Activity Messenger also allows you to streamline recurring payments with Interac e-Transfers.

Setting up pre-authorized billing for your membership-based business is a smart move that streamlines payments and improves financial stability. By choosing the right provider, obtaining proper authorization, and communicating effectively with your members, you can ensure a smooth transition to automated billing.

Want an all-in-one solution? Activity Messenger integrates payment collection, billing, and customer communication, making it easy to manage pre-authorized debits for your business.

Get started today and simplify your membership payments!

Click here to book a call with an Activity Messenger expert.