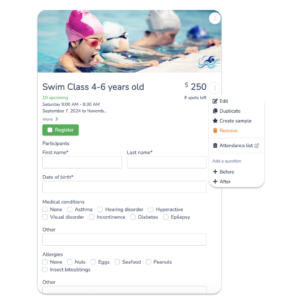

One of the most cost-effective ways to collect online payments in Canada is to use Interac e-Transfers.

However, tracking all the payments can be a headache when dealing with hundreds of registrations, such as dance studios, gymnastics clubs, or swim schools.

So many turn to credit cards with their much higher fees.

But what if you could get all the streamlined benefits of credit card payments with the low fees of Interac transfers?

In this article, we’ll discuss;

Author’s note: Olivier shares tips and tricks he’s learned over the past decade as the owner of a kids’s activity center working with many different online registration tools. Today, as the co-founder of Activity Messenger, he now helps hundreds of organizations in North America improve their online registration process and increase their conversion rates.

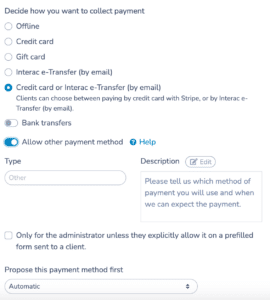

Multiple payment options are essential to ensure a better registration process and accommodate different customer preferences. That’s why including Interac e-Transfers is beneficial:

| Interac | Credit card | Bank transfer | Offline | |

|---|---|---|---|---|

| Processing fees* | 0% | 2.9% + 30c | 1% + 40c | Yes |

| Payout | Instant | 1-3 days | 5 days | Client dependant |

| Settlement | Automated** | Automated | Automated | Manual |

Cost efficiency is a major advantage of using Interac e-Transfers for your registration forms:

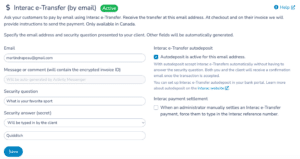

Now offered through Interact, Autodeposit is a powerful feature that can streamline payment processing even further:

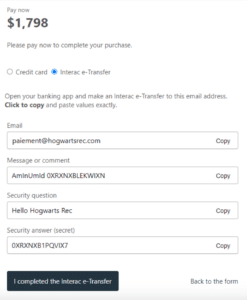

Integrating Interac e-Transfers into your registration form facilitates automatic payment settlement, providing several benefits:

💬 What our customers say:

“Adding Interac e-Transfer by email as an option to pay online has saved thousands of dollars a month in credit card fees. This was made possible by Activity Messenger’s auto-reconciliation, which saves us 3 days of admin work a week!” — Duncan M., Founder & CEO, HamOnt Sports

📌 Pro Tip: A registration platform that integrates with Interac like Activity Messenger is able to settle automatically invoices and mark them as paid. Activity Messenger will match the encrypted invoice ID typed in by the client in the message or comment field.

To maximize the benefits of using Interac e-Transfers on your registration forms, here are a few crucial steps:

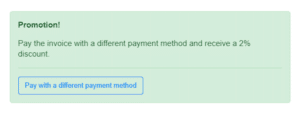

You can incentivize clients to use Interac e-Transfers to reduce transaction costs and encourage e-transfer payments. Here’s how you can leverage rebates to promote alternative payment options:

Using Interac e-transfers can result in huge cost savings in transaction fees. But it also comes with the burden of manually processing each transfer and following up with parents who have registered but not yet paid for their session.

Activity Messenger is designed to help you keep the savings from using Interac, but also streamline the process and save you hours tracking payments – it’s the best of both worlds!