If you’re running a business that relies on online registrations and payments, you know credit card processing fees eat into your profit margins.

By offering automated Interac e-transfers as a payment option for your clients, you can significantly reduce processing fees while keeping all the benefits that credit card payments offer.

This is especially true if you are running a service business with a high level of registrations, like Dance studios, Gymnastics clubs, Swim schools or summer camps.

In this article, we’ll explore how you can reduce credit card fees by automating Interac E-Transfers.

Author’s note: Olivier shares tips and tricks he’s learned over the past decade as the owner of a kids’s activity center working with many different online registration tools. Today, as the co-founder of Activity Messenger, he now helps hundreds of organizations in North America improve their online registration process and increase their conversion rates.

Credit card processing fees typically range between 2.5% and 3% per transaction, depending on your service provider and the type of card being used. Over time, this adds up, especially for businesses with high transaction volumes.

In contrast, Interac e-transfers come with a much lower fee structure. Most transfers only incur a small, flat fee (usually between $0.50 and $1.0) or are free, depending on your bank and account type. For organizations taking in a large number of registrations, this can result in substantial savings.

————–

| Interac | Credit card | Bank transfer | Offline | |

|---|---|---|---|---|

| Processing fees* | 0% | 2.9% + 30c | 1% + 40c | Yes |

| Payout | Instant | 1-3 days | 5 days | Client dependant |

| Settlement | Automated** | Automated | Automated | Manual |

Advantages:

Disadvantages:

Advantages:

Disadvantages:

Many Canadian businesses are reluctant to accept Interac e-Transfers when collecting a high volume of payments because of the manual work involved. However, with the right registration platform, you can automate this process to make it as seamless as accepting credit cards.

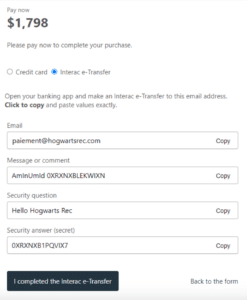

Activity Messenger provides a fully automated solution for processing and settling Interac e-transfers. Participants fill out their registration form and are prompted to pay with Interac when they get to the invoice, where they can easily transfer funds through their banking app.

Once the payment is received, it’s automatically matched to the corresponding invoice/registration in the account. This eliminates the need for verification, ensures a smoother transaction process, and automatically settles invoices as payments are received into your bank account.

When looking for an online registration platform that supports Interac E-transfers, there are several key factors to consider:

Switching to Interac E-transfers is a great way to reduce credit card fees.

When automated through a platform like Activity Messenger, you can enjoy the benefits of lower fees, faster payments, and fewer manual tasks, all without sacrificing customer convenience.

Take the time to evaluate your options and find a registration platform that fits your needs, and start enjoying the savings today.