For small businesses in Canada—especially those in class-based industries like dance studios, swim schools, and martial arts academies—offering flexible and automated payment options is crucial. One of the most efficient ways to collect recurring payments in Canada is through Pre-Authorized Debits (PADs).

This guide will explain how PADs work, why they’re beneficial for your business, and how you can integrate them into your registration process for monthly memberships and payment plans.

A Pre-Authorized Debit (PAD) is an agreement between a business and a customer that allows the business to withdraw funds directly from the customer’s bank account at set intervals. PADs are widely used for subscription services, memberships, and installment-based payments, making them ideal for businesses that rely on recurring revenue.

To accept PAD payments, you need a service provider that facilitates direct bank withdrawals. Some popular PAD processing platforms in Canada include:

Before withdrawing funds, you need a signed authorization from your customers. This can be done through:

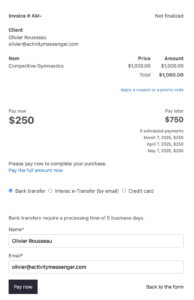

Many businesses integrate PAD authorization directly into their registration forms. This is particularly useful for class-based businesses that offer multiple payment installments.

Once a PAD agreement is in place, you can set up automated withdrawals according to your billing schedule. Examples include:

Using a registration system with built-in PAD, like Activity Messenger, can simplify the process of both collecting payments and managing communications with your clients.

In Canada, PAD transactions are regulated by Payments Canada. To remain compliant, you must:

While PADs have a high success rate, occasional payment failures can still occur due to insufficient funds or account changes. Having a system that notifies you of failed transactions and allows you to easily retry is critical.

For businesses that rely on registrations and recurring monthly payments, integrating PADs into your registration forms can make a significant difference. With platforms like Activity Messenger, you can:

Automated reminders help reduce late payments without requiring manual intervention from your staff.

Pre-Authorized Debits can be a game-changer for small businesses that operate on a recurring revenue model. Whether you run a dance studio, a gymnastics club, or a swim school, offering PADs as a payment option can:

✅ Reduce admin work

✅ Improve cash flow

✅ Save you money on transaction fees

If you’re looking for a registration and payment solution that supports PADs, check out Activity Messenger. Our platform helps class-based businesses automate their registration forms, payment collections, and customer communications—all in one place.

Click here to book a call with an Activity Messenger expert.